Life Insurance in and around Preston

Get insured for what matters to you

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

People decide to get life insurance for a variety of reasons, but the ultimate goal is usually the same: to ensure a certain financial future for your partner after your passing.

Get insured for what matters to you

Now is a good time to think about Life insurance

Life Insurance You Can Trust

When deciding on what type of policy is appropriate, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like the age you are now, your physical health, and perhaps even gender and occupation. With State Farm agent Travis Chase, you can be sure to get personalized service depending on your unique situation and needs.

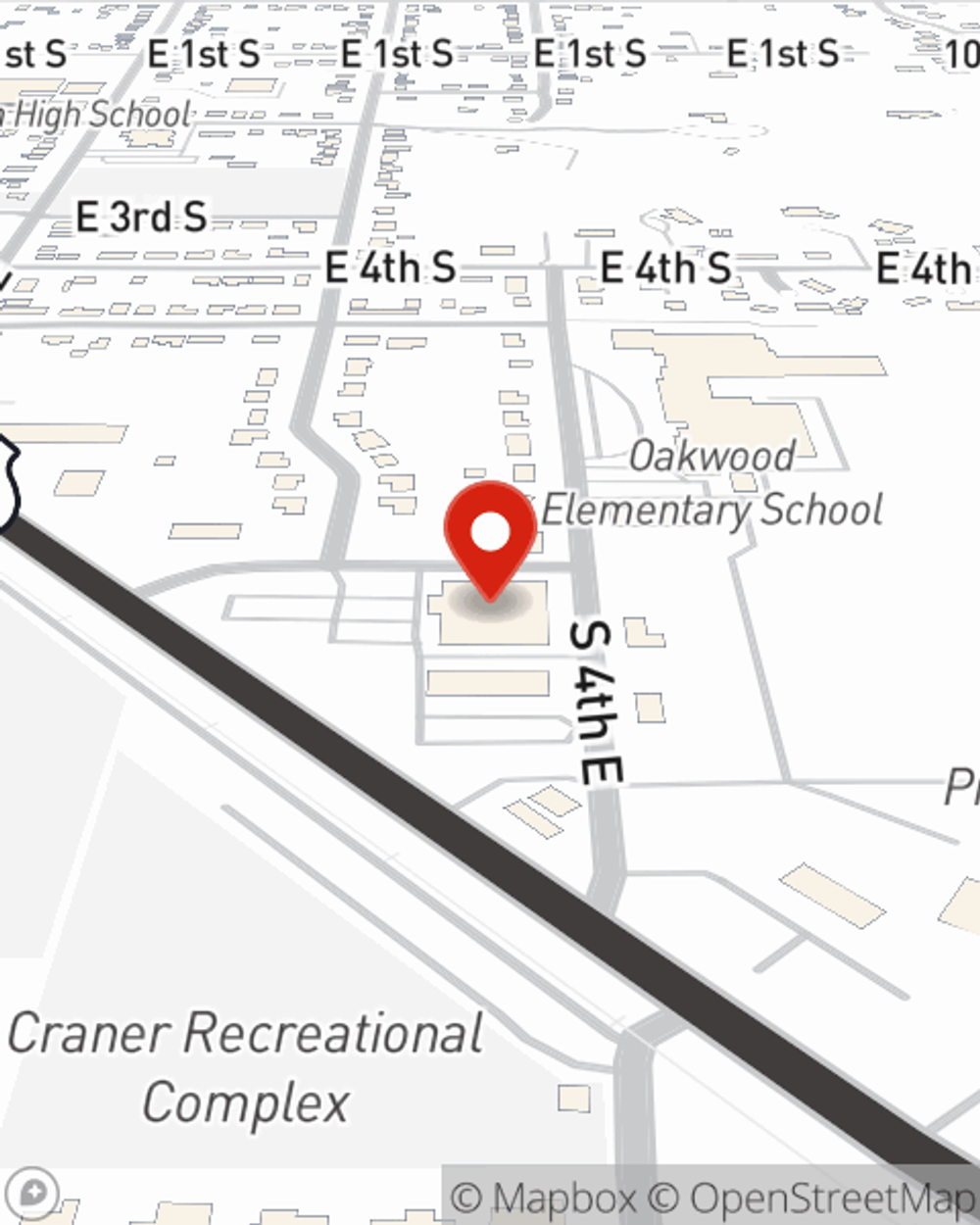

To experience your Life insurance policy options, visit Travis Chase's office today!

Have More Questions About Life Insurance?

Call Travis at (208) 852-3303 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Travis Chase

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.